Market Street Group LLC

Providing above-market yields for sophisticated investors

About us

Founded in 2012, Market Street Group is a real estate investment manager that serves two major constituencies: residents looking for high-quality affordable housing, and sophisticated investors seeking above-market yields in the form of both monthly distributions and long-term equity growth.

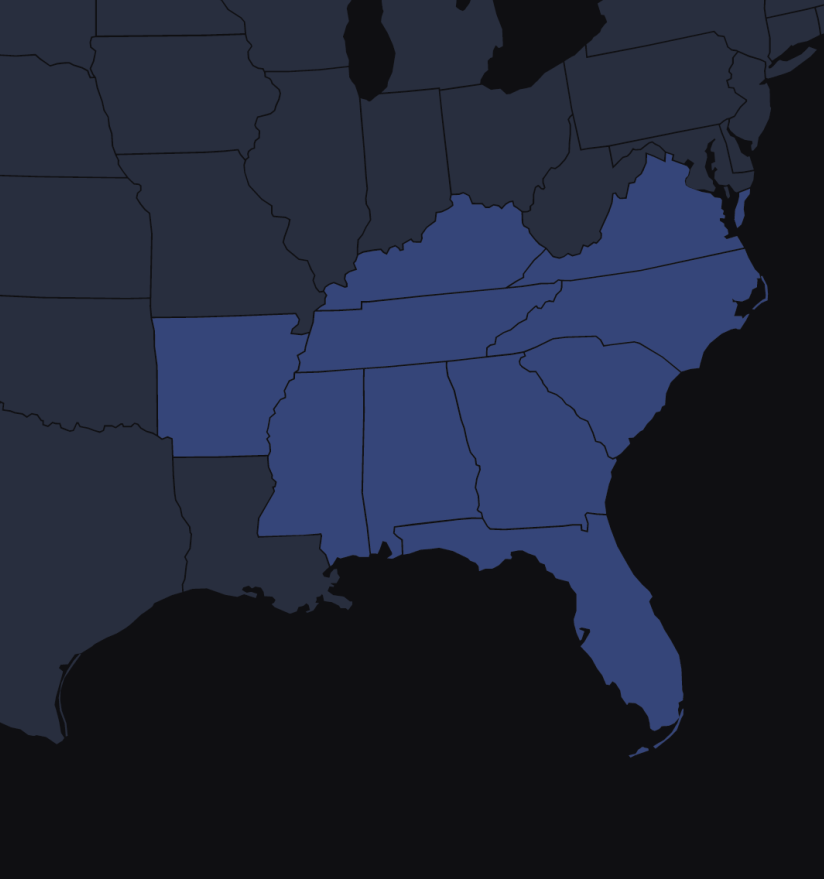

Through a variety of innovative investment strategies focused on high-quality multifamily housing in the southeastern U.S. we have achieved a long history of market-beating returns for our investors.

Our priorities include the thoughtful navigation of ever-changing real estate cycles and intelligent risk mitigation through detailed due diligence.

Our Portfolio

Since its inception, Market Street Group has focused exclusively on multifamily investment in the fast-growing southeastern U.S. By keeping acquisitions within specific targeted regions and by handling all property management "In house", Market Street Group is able to minimize operating expenses and maximize distributable monthly income and equity growth for investors without compromising quality of life for its residents.

Mobile Home Communities

$4.1M multifamily project with 102 units

RV Parks

Mixed use project with 70 residential and 2 commercial units

Our Strategy

Our Team

Gary Bellomy

Founder and Managing Partner

In 2006, Mr. Bellomy formed MSG’s predecessor (and part owner) Market Street Capital, Inc. with the specific intent of capitalizing on the anticipated real estate crisis that ensued. MSC prioritized the acquisition of high quality residential and commercial assets in the coastal southeast with a particular focus on Georgia and South Carolina due to their high concentration of struggling community banks with real estate-based portfolios. A majority of MSC’s acquisitions have been made from or in cooperation with community and regional banks. In late 2010, Mr. Bellomy recognized the shortage of affordable housing and, combined with the availability of attractive mobile home community acquisition opportunities, set in motion the strategic shift that has symbolized MSG’s investment strategy over the last several years and has resulted in the acquisition of over 50 mobile home communities across seven states with a total value in excess of $250,000,000. MSG and its investment partners have most recently been focused on the sale of its mobile home community portfolio to capitalize on the dramatic cap rate compression that the asset class has experienced. Sales to date have yielded investment partners an average ROI of over 1.5x.

Ryan Siemens

Partner

Mr. Siemens, who joined Market Street in mid-2012, has spent most of his career sourcing, structuring, financing and monitoring investments tailored for high net-worth and institutional investors. From 2004 until mid-2010, he was a principal of Waveland Capital Group, which served as Managing Member for numerous venture capital and private equity funds and as placement agent for numerous startup companies and private equity funds. Prior to joining Waveland in 2001, Ryan served in analytical roles for two substantial real estate investment companies: commercial investor and developer SIA Partners Ltd. from 1992 until 1995 and diversified institutional investor Nearon Enterprises from 1995 until 1997. Mr. Siemens is a graduate of the University of California, Berkeley and received an MBA from the Thunderbird School of Global Management (now operated by Arizona State University).

Jamie Coleman

Partner

With over 15 years of experience in operations, Jamie serves as MSG’s partner in charge of operations. In this capacity, he directs regional operations for MSG-managed assets. Mr. Coleman has had direct executive and onsite experience in real estate management, project development and sales and marketing. Throughout his career, Mr. Coleman has demonstrated his ability to grow revenues while helping to streamline operations and moderate expenses. Mr. Coleman supervises and oversees the various MSG Regional Managers and is in charge of the maturation and formalization of all operations. retention, maintenance, onsite manager recruiting, outbound marketing (including initiating an online presence for most MSG assets) and the ongoing development of state-of-the-art reporting systems.

Heather Milliken

Chief Operations Officer

Ms. Milliken joined MSG in 2014 after over 12 years in the real estate sector and serves as MSG’s Chief Operating Officer. In the COO position, Ms. Milliken directly supervises property-level and asset-level management to maximize collections and cash flow for each property and investment partnership. Ms. Milliken began her career in retail management prior to transitioning to residential and commercial real estate in sales and property management. She started with MSG as Community Asset Coordinator before being promoted to General Manager then COO.

James Jackson

Chief Financial Officer

Mr. Jackson joined MSG in 2016 and serves as MSG’s Chief Financial Officer. Prior to joining MSG, he served in managerial roles in the foodservice business and rose from a service position with Bon Appetit Management Company to become Manager of Operations then Assistant Accountant.